Taxes and Loopholes

Christian Restorative Justice and Corporate Law

Photograph: Protest of corporate tax policy in 2018; Apple estimated to avoid $4 billion in taxes. Photo credit: Steve Rhodes, Creative Commons 2.0, Flickr.

Introduction

This page has resources on various taxes, proposed and implemented. They list arguments for and against, paying special attention to taxes as at least potentially constructive and beneficial. This view is based on the Christian moral argument that human community comes before private property, so taxation is not in principle immoral. Nor is it intrinsically theft, as libertarians argue. Furthermore, goods that are funded by taxpayers and created by the government — technology, infrastructure, medicine, etc. — become privatized for private gain, so taxation is a way to express past public investment. The issues covered below focus on corporations. See Taxes for more on philosophical and historical issues related to taxes on individuals and households.

Other Resources on Taxes and Loopholes

The Daily Take, Meet America's Biggest Welfare Queens. Truthout, Nov 25, 2013.

Nicholas Kristof, The Real Welfare Cheats. New York Times, Apr 14, 2016.

Paul Krugman, Robber Baron Recessions. NY Times, Apr 18, 2016.

Paul Krugman, It Takes a Policy. NY Times, May 16, 2016. On policy priorities and spending (of all sorts) for children

Christopher Helman, What America's 25 Most Profitable Companies Pay in Taxes. Forbes, Jul 4, 2016.

Matt Bruenig, The Rich Already Have UBI. Jacobin Magazine, Jan 2, 2017. “10 percent of all national income is paid out to the 1 percent as capital income. Why not give it to all as a universal basic income?” Dividends, interest, rents, etc.

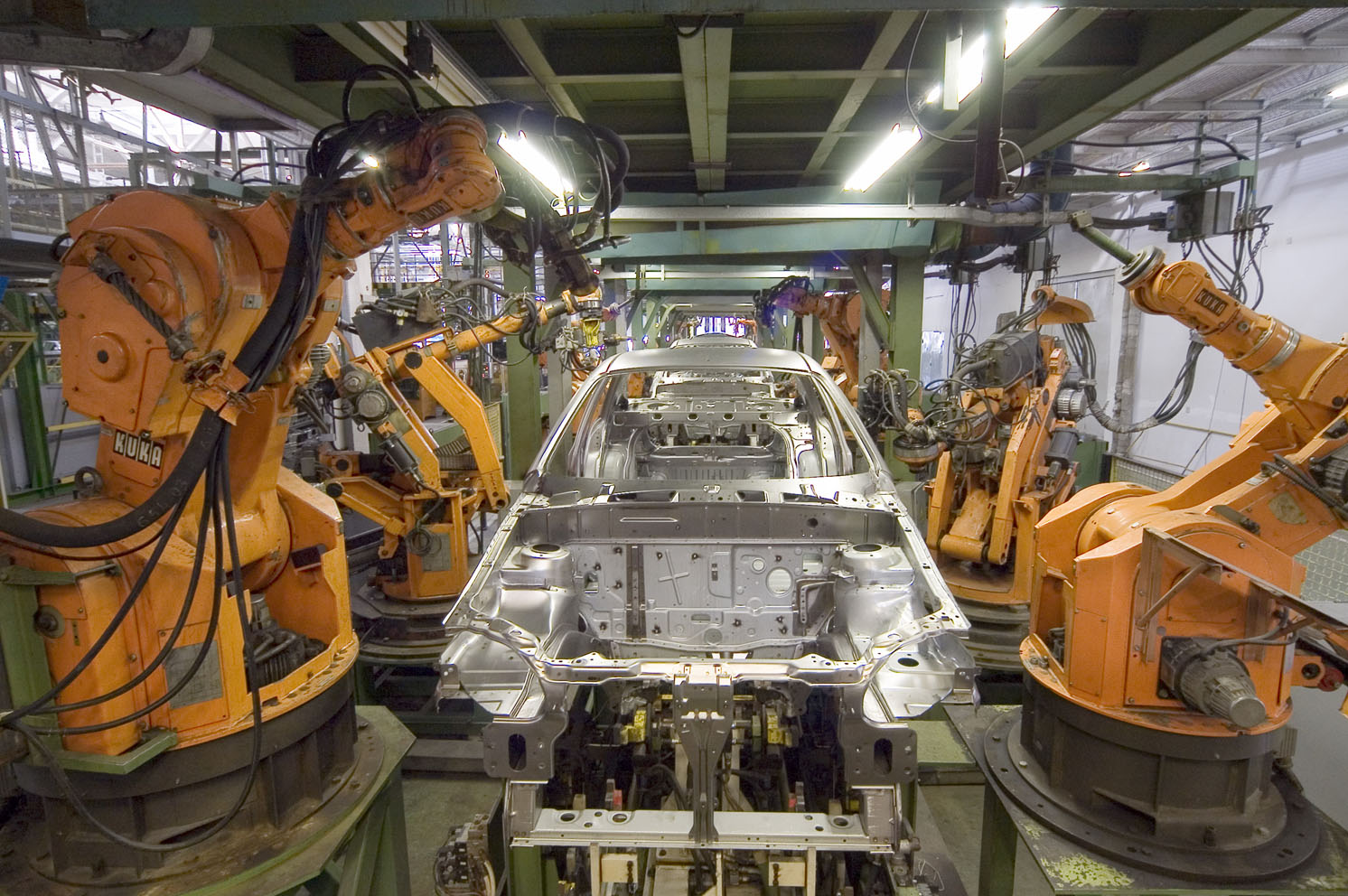

Emily Stewart, Harley-Davidson Took Its Tax Cut, Closed a Factory, and Rewarded Shareholders. Vox, May 22, 2018. See also Emily Stewart, Walmart is Paying $20 Billion to Shareholders. With That Money, It Could Boost Hourly Wages to Over $15. Vox, May 25, 2018. See also Noel Randewich, S&P 500 Companies Have Returned $1 Trillion to Shareholders in Tax-Cut Surge. Business Insider, May 26, 2018. See also Branko Marcetic, Here’s How Much Money America’s Biggest Corporations Have Stolen From Their Own Workers. Jacobin Magazine, Jun 2018.

Doug Bandow, Corporate Welfare Lives On and On. The American Conservative, Aug 29, 2018.

Jim Tankersley, Amazon’s New York Home Qualifies as ‘Distressed’ Under Federal Tax Law. NY Times, Nov 14, 2018.

Krystal Ball and Saagar Enjeti, Media Screwups: Billionaire STUNS Saying Let Mega-Rich FAIL, Noam Chomsky Reacts to Bernie Loss. Rising | The Hill, Apr 11, 2020. One of the first employees at Facebook (worth $1.1 billion) argues that financial investors (speculators, equity investors) should be allowed to bear the brunt of corporate failure, because packaged bankruptcies allow employees, pensioners to own more of the companies. See Sissi Cao, Chamath Palihapitiya Blasts Fed for Bailing Out Billionaires and CEOs Amid Pandemic. Observer, Apr 9, 2020. For more of Palihapitiya’s views on central banking. For critiques of the nuances of bankruptcies, Julia Reinstein, A Venture Capitalist Is Going Viral For Saying The Government Should Let Some Billionaires "Get Wiped Out". Buzzfeed News, Apr 10, 2020. See also David Doel, Billionaire Stuns CNBC Host: “Let Them Get Wiped Out”. Rational National, Apr 10, 2020.

Johnny Harris, Where the U.S. Hides its Secrets. Johnny Harris, Nov 24, 2020. Corporate tax havens are centered in small countries. Harris spotlights Monrovia, Liberia. One U.S. company controls flag rights for a shipping registry, and kicks back some profits to the Liberian government. Charles Taylor was a brutal Liberian dictator who profited from this money.

Ryan Grim and Alyssa Farah, Facebook Paid Billions Extra To Protect Zuckerberg From Legal Action In Cambridge Analytica Suit. Rising | The Hill, Sep 24, 2021.

James Li, Stock Buybacks Are Destroying American Economy. Breaking Points with Krystal and Saagar, Aug 27, 2022. In the last 10 years, the top 20 companies on the S&P 500 bought back about $1.3 trillion in stock shares, with Apple leading the list by far. Because this removes stocks from the market, it artificially boosts Earnings Per Share. Yet companies depleted their cash prior to the COVID pandemic and then begged for cash from the government -- something individual people would be excoriated for doing. Also, company executives were much more likely to engage in insider trading when stock buybacks happened. Also, company executives are relying on debt to finance stock buybacks. James Li also comments on government policies that address stock buybacks.