Public Banking

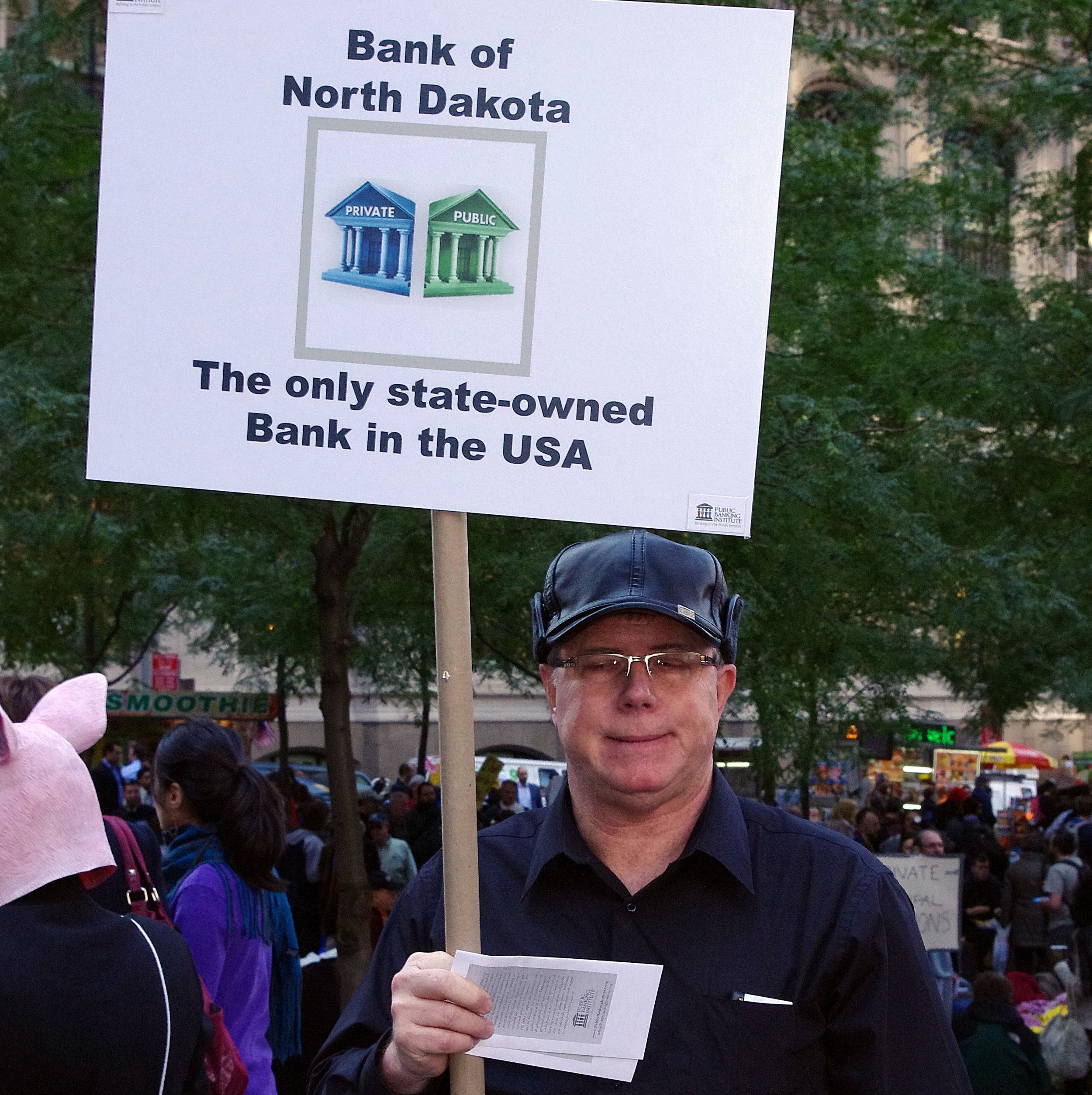

Photograph: A man during the October, 2011 Occupy Wall Street protest, promoting awareness of the Bank of North Dakota, a state-owned bank. Photo credit: David Shankbone | CC3.0, Wikipedia.

Introduction

These resources explore the need for, and actual practice of, public banking or socialized banking, due to moral and ethical problems found in the American financial system. Private banks are allowed to use fractional reserve banking, and are therefore vulnerable to bank runs. They are already bankrupt, since if all depositors withdrew their money at the same time, the bank would collapse. But private banks are kept alive by a combination of statistical risk-management (the likelihood that people will not do that at once) and government regulations and backstops like the Federal Deposit Insurance Commission (FDIC).

Resources on Public Banking

California Infrastructure and Economic Development Bank (website)

Public Banking Institute (website)

Wikipedia, Bank of North Dakota (Wikipedia article)

Fred Moseley, Banks: Time for Permanent Nationalization. Alternet, Mar 3, 2009. If banks are "too big to fail," they should be public.

Josh Harkinson, How the Nation’s Only State-Owned Bank Became the Envy of Wall Street. Mother Jones, Mar 27, 2009.

Associated Press, Bank Of North Dakota: America's Only 'Socialist' Bank Is Thriving During Downturn. Huffington Post video, May 25, 2011.

Les Leopold, Why Is Socialism Doing So Darn Well in Deep-Red North Dakota? AlterNet, Mar 29, 2013.

Penelope Lemov, The Case for a State-Owned Bank. Governing, Apr 12, 2012.

Opinions, Should States Operate Public Banks? New York Times, Oct 1, 2013.

Eric Hardmeyer, Why Public Banking Works in North Dakota. New York Times, Oct 1, 2013. Hardmeyer is President and CEO of the Bank of ND.

Ellen Brown, Public Banks Are Essential to Capitalism. New York Times, Oct 2, 2013.

Demos, How State Banks Can Reduce Student Debt. Demos, Apr 24, 2014.

Finance, Hawaii Seeking to Create the Nation's Second State-Owned Bank. Governing, Feb 3, 2015.

Eric Levitz, Democrats Have a Plan to Save the Post Office – and Kill Payday Lenders. New York Magazine, Apr 25, 2018. See also Daniel Marans, Kirsten Gillibrand Unveils A Public Option For Banking. Huffington Post, Apr 25, 2018.

David Dayen, Bill Aimed at Community Banks is Already Killing Them. The Intercept, May 16, 2018. Dayen discusses the Bank of North Dakota.

Jill Cowan, Could Public Banks Help Cities Keep Their Money Away From Wall Street? New York Times, Jun 11, 2019.

Will Peischel, How a Brief Socialist Takeover in North Dakota Gave Residents a Public Bank. Vox, Oct 1, 2019

“North Dakota’s government-owned bank has been a celebrated institution for a century. Now California might get one, too.” “There have been efforts to establish public banks in nearly two dozen other states. This year alone, four state legislatures beside California — New York, New Mexico, New Hampshire, and Massachusetts — have introduced bills to create or explore creating public banks. None, however, have passed.”

David Dayen, USAA Grabs Coronavirus Checks From Military Families. The American Prospect, Apr 16, 2020. “The bank, one of the nation’s largest, has told customers it would use the $1,200-per-person payments to offset existing debts.” USAA backed off: Jake Johnson, Outrage Over Plan to Seize Stimulus Payments Forces At Least One Bank to Reverse Course. Salon, Apr 17, 2020. But it is very likely that this government bailout/stimulus goes to keep banks and lenders afloat. Why not just let those lenders fail, and build a public taxpayer-funded community bank in their place? And/or nationalize and democratize the Federal Reserve?

John Laidler, Should Massachusetts Create a Public Bank? Boston Globe, Sep 16, 2021.

David Dayen, New Postal Banking Pilots Trigger Praise, Concern. The American Prospect, Oct 5, 2021.

“Cautious optimism has followed the U.S. Postal Service’s announcement that it has begun a test of new products that take small steps toward re-establishing a postal banking program. Customers can now convert business or payroll checks of $500 or less onto a single-use gift card for a $5.95 purchase fee.”

Ryan Grim and Robby Soave, David Dayen: USPS Pilot Banking System Could Benefit Millions Of Americans, Negotiated By Unions. Rising | The Hill, Oct 10, 2021.

Massachusetts State Senate, Bill S.632: An Act to establish a Massachusetts public bank. MA Legislature, Feb 16, 2023. See also Massachusetts State Senate, Order relative to authorizing the joint committee on Financial Services to make an investigation and study of certain current Senate documents relative to financial services. MA Legislature, May 20, 2024.

Gary Stevenson, Who’s Getting Rich From Your Mortgage? Gary’s Economics, Feb 23, 2025. British economist Gary Stevenson explains why banks are middlemen for the rich. This is an argument for a public option for a publicly owned bank, where the community benefits and governs.

Hank Green, DOGE Just Ended Nuclear in America. Hankschannel, Apr 24, 2025. Hank covers the Loan Programs Office, a public infrastructure venture capital bank. The LPO was the government organization that gives loans to new technology development, including Tesla and Solyndra. Solyndra became a big PR fiasco, but the LPO manages half a trillion $ with 200 employees under Biden’s Inflation Reduction Act, and earned a return of $5.6 billion in 2024, and default rate on loans of under 4%. Private banks are too risk averse to make these capital investment loans. The LPO is the only bank funding nuclear projects, and companies like XEnergy, Terra, and Oklo. They do solar, geothermal, wind, battery technology. China’s version of this is probably about 5x bigger but is not transparent. For more info, see Wikipedia.