Islamic Banking

Photograph: NBC Islamic Banking billboard in Kiponda District, Stone Town, in Zanzibar, Tanzania. Picture credit: Adam Jones | CC2.0.

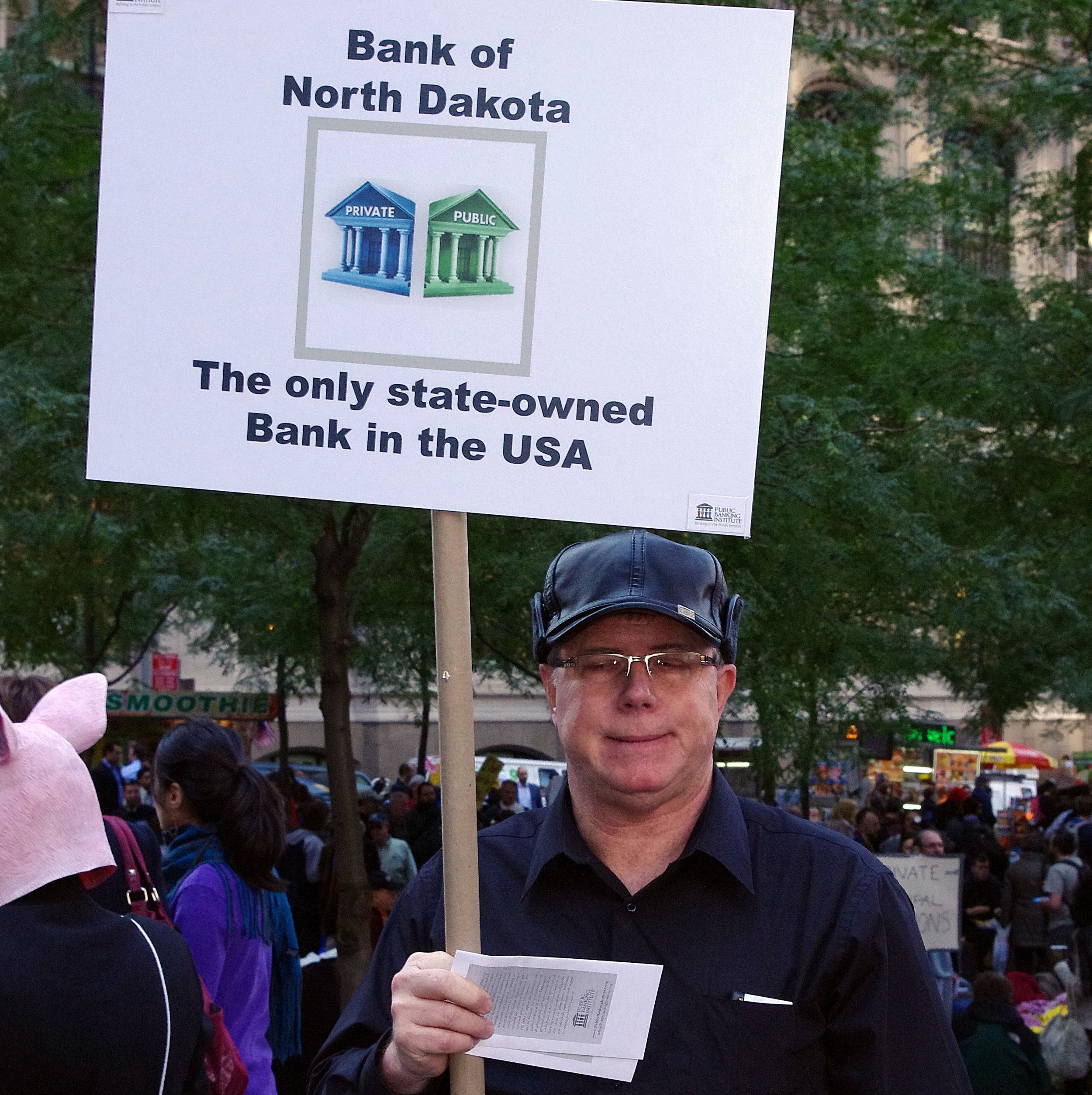

These resources explore Islamic banking, its foundations in the Quran, and how Muslims have carried this institution forward. Islamic banking is interesting because they charge fees for service, rather than promise interest rates to depositors. The basic principle of Islamic banks is to avoid interest rate promises. So they charge a small fee for banking services, and compete with each other based on who charges lower fees. It is still capitalist. By contrast, our non-Islamic banks make money by legalized gambling with debt. They compete with each other by promising higher interest rates on your deposits. But they have to make that money and also pay their staff by using your money to make investments, all the while gambling that you won't need to withdraw all your money at once. Meanwhile, our banks lobby lawmakers to loosen regulation, shut down postal banking (which used to exist in the U.S.), and oppose public options for banking, while they ask for bailouts when they fail. Thus, private banks inherently privatize gains and socialize losses. Is that "capitalism"? Is it wise for us to have fictional dollars circulating in the economic system (created by fractional reserve banking) that accountants call "assets" on the same level as physical assets?

Resources on Islamic Banking

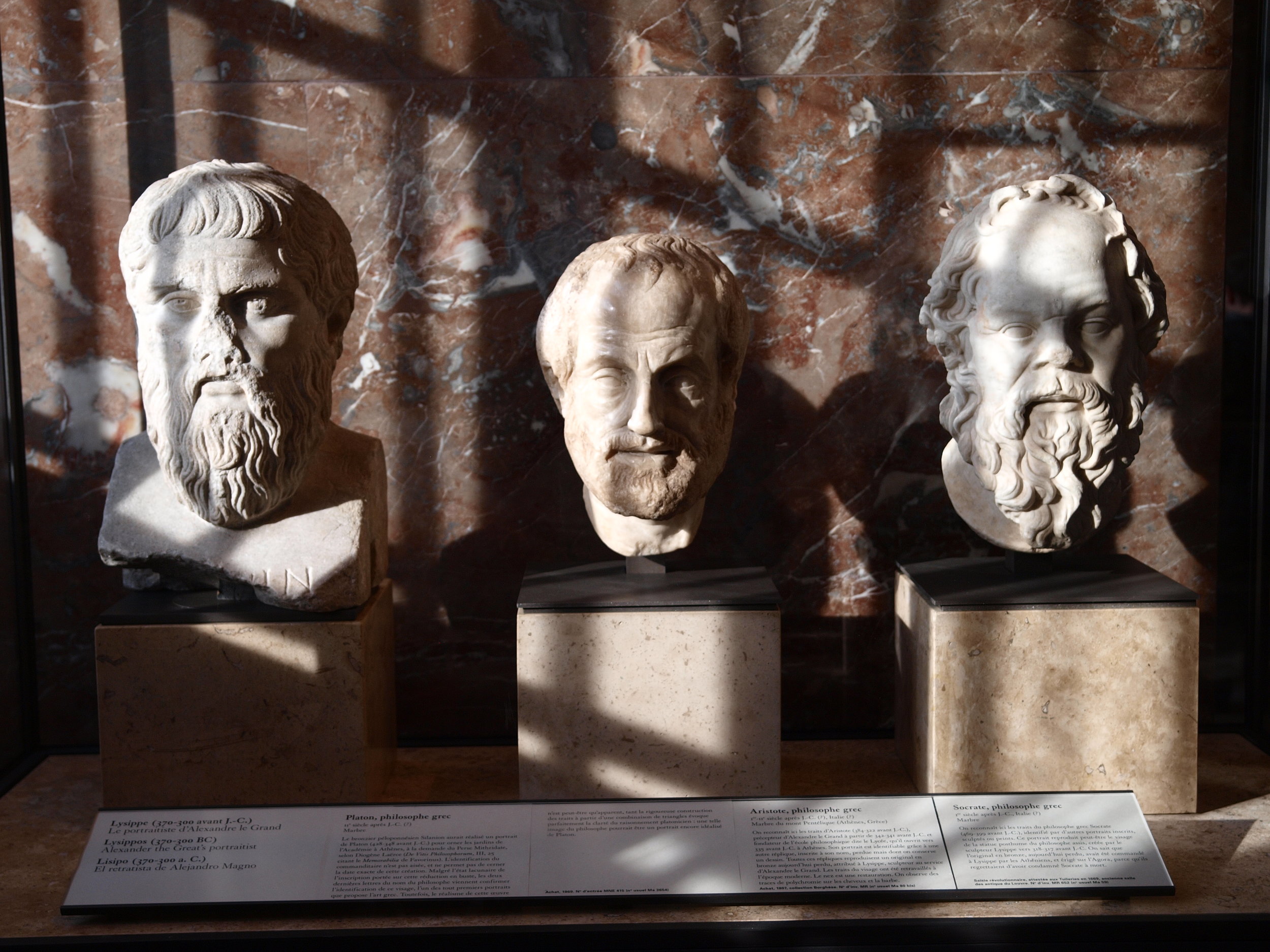

The Quranic verses and Hadiths and the Islamic tradition which are anti-usury: Usury and Interest Rates in the Qur’an (Submission.org) and Islamic Party of Britain, The Facts About Usury: Why Islam Is Against Lending Money At Interest (Islamic Awareness) and Fatwa 86959 and 84764, Why Usury is Prohibited (Islamweb.net, Apr 3, 2010)

Economist, Banking Behind the Veil. Economist, Apr 4, 1992.

Economist, Forced Devotion: Pakistan's Banks Have Four Months to Turn Islamic. Economist, Feb 15, 2001.

African Business, Islamic Banking Strides Across Africa: Islamic Banking, Already a Significant Factor Around the World, Is Now Making Substantial Inroads in Africa. African Business, Jun 1, 2007.

Arab News, New Model for Future of Islamic Banking Planned. Arab News, Jun 20, 2007.

Global Banking News, Alliance Bank Planning to Grow Islamic Banking Assets. Global Banking News, May 16, 2008.

TradeArabia, Al Hilal Bank Backs Islamic Banking Summit. TradeArabia, Dec 18, 2012.

Economics Explained, Do We Actually Need Debt? Economics Explained, Apr 19, 2020. Takes a surprising and refreshing turn by examining Islamic banking, which is equity driven and not debt-driven, disallows fractional reserve banking.

Ainara García Sánchez, Islamic Finance: A Sharia-based Form of Economy? Funci: Islamic Culture Foundation, Jun 2, 2023.

Modern MBA, Western Union: Banking and Finance for the Poor. Modern MBA, Jul 9, 2023. A parallel to Islamic fee-based banking:

“Banks make money by lending out the money that you deposit. The more cash you put in, the better your treated - transactions take priority, fees get waived, interest rates are higher, and a personal banker is assigned. On the flip side, the less money in your account, the more fees you pay, and the further back in the line you start from. Banks chase affluent accounts who bring large balances and high cash flow. But it’s not just banks - every business aims for as many high spenders and wealthy as possible. Yet there are 2 companies - Western Union and MoneyGram, that have gone in the opposite direction in providing financial services in peer-to-peer money transfer (international & domestic) to a population that banks deem to be too poor and too low-value. Migrant workers and the poor are left out of the global financial system for similar reasons: they have too little money, their employment is volatile, their earnings are inconsistent, there are significant language and cultural barriers, they lack documentation, etc. In this episode, we’ll cover the business of Western Union and MoneyGram, how these companies drive economic growth in developing countries, and how the market is pushing their evolution into a bank for the poor.”